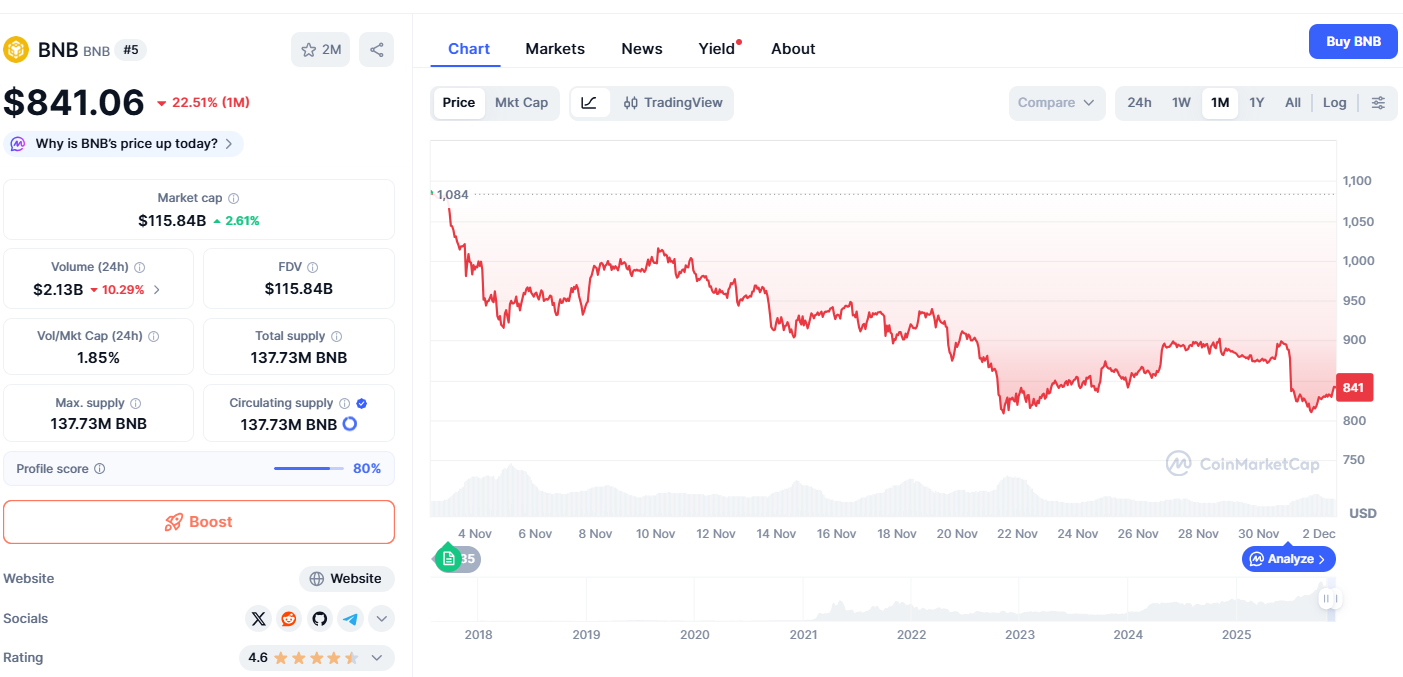

Data confirms the Fed conducted a $13.5 billion overnight repurchase agreement (repo) operation on December 1. This intervention marks the second-largest liquidity injection since the 2020 crisis, exceeding levels seen even during the dotcom bubble.

Cantor’s ‘Solana Alpha’ While the Fed provided the fuel, Wall Street provided the spark.

Cantor Fitzgerald, the prime brokerage giant known for managing Tether’s Treasury portfolio, disclosed a $1.28 million position in the Volatility Shares Solana ETF via regulatory filings.

Source: https://coinedition.com/crypto-market-rebounds-today-fed-qt-ending-cantor-solana-etf-bitcoin-rally/

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments